Overview: What Is the California Film and TV Tax Credit?

The California film and TV tax credit is the state’s flagship incentive designed to keep production jobs in Hollywood’s home turf.

Established in 2009 and revamped multiple times, the program currently allocates $330 million per year in refundable tax credits to qualifying feature films, episodic series, indie projects, and relocating TV shows.

Productions receive 20‑25 percent credits on below‑the‑line wages and qualified spend, with uplift bonuses for out‑of‑zone shoots, diversity hiring, and visual‑effects work.

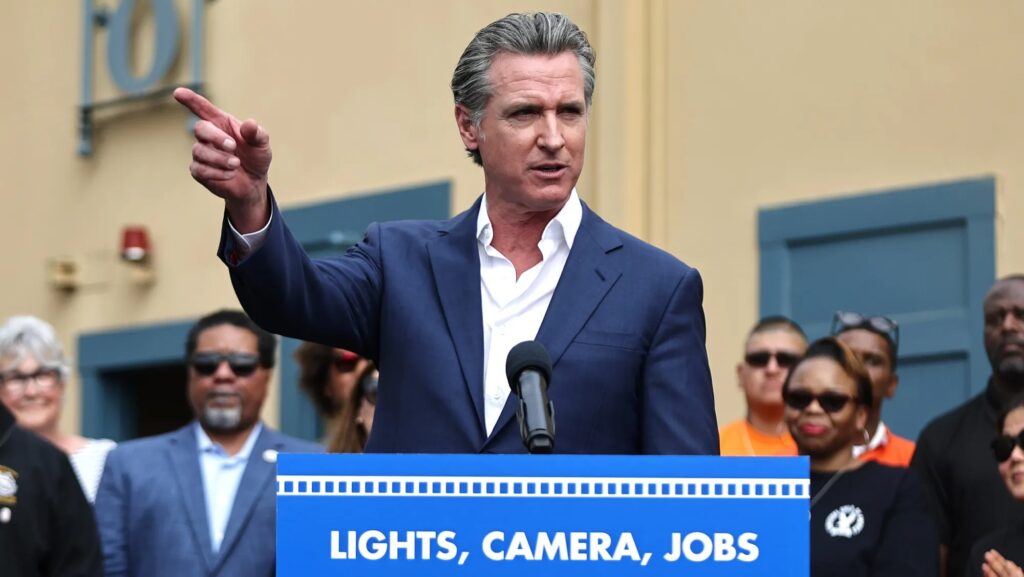

2025 Proposal: A $420 Million Boost

Governor Gavin Newsom’s latest budget includes a $420 million one‑time expansion, raising the annual pool to $750 million for fiscal years 2025‑26 and 2026‑27.

The proposal is bundled into a “trailer bill,” allowing swift legislative approval despite the state’s $12 billion deficit.

Lawmakers say the enlarged California film and TV tax credit could hit set floors as soon as July 2025 if passed this month.

Key Changes Under the Expansion

| Category | Current Program | Proposed Boost |

|---|---|---|

| Annual Allocation | $330 M | $750 M (2025‑27) |

| Episodic Cap | $20 M/season | $40 M/season |

| Bonus for Out‑of‑LA Counties | 5 % | 10 % |

| Reality/Game | Not eligible | Large‑scale competition shows eligible |

| Diversity Uplift | 4 % | 8 % (targets hiring grads of training orgs like Hollywood CPR) |

Why the Expansion Matters Now

- Runaway Production – Since 2019, California’s share of big‑budget features has plummeted from 39 percent to 21 percent, with projects fleeing to Georgia, the U.K., and New Mexico.

- Post‑Strike Recovery – SAG‑AFTRA and WGA walkouts froze local shoots for nearly nine months; unions say doubling the California film and TV tax credit will reignite payrolls.

- Infrastructure Preservation – Empty stages at Manhattan Beach and Santa Clarita risk permanent conversion into logistics warehouses if bookings don’t rebound.

Lobby Day: Hollywood Comes to Sacramento

On June 11, Wonder Woman director Patty Jenkins, Fallout producer Jonathan Nolan, Lost co‑creator Damon Lindelof, and Oscar‑winner Cord Jefferson descended on the Capitol to urge quick passage.

Organized by producer‑activist Scott Budnick, the delegation emphasized that delaying the boost until 2026 could cost California the third season of Fallout and Ang Lee’s 1870s Gold‑Rush epic.

“Six months could be decisive,” Nolan warned lawmakers, adding that infrastructure in L.A. “will shrivel up and die” without immediate certainty.

Economic Arguments For and Against

Supporters Claim

- 4x ROI: The state estimates every $1 of California film and TV tax credit generates $4 in economic output—hotel nights, small‑business spending, tourism exposure.

- Union Jobs: IA Local 44 projects 20,000 additional set‑dresser workdays per $100 M credit increase.

Critics Counter

- Budget Crisis: Progressive caucus members argue the state shouldn’t boost subsidies while trimming social programs.

- Corporate Giveaway: Watchdogs note top studios reported $7 billion in aggregate profits last quarter; they question if incentives merely pad margins.

How California Compares Globally

| Jurisdiction | Annual Pool | Max Credit % | Key Perks |

| Georgia | Unlimited | 30 % transferable | No salary caps, single audit |

| U.K. | Unlimited | 39 % rebate | Dollar‑per‑pound parity, crew training grants |

| Canada (B.C.) | Unlimited | 28‑35 % | F/X bonus, weak USD advantage |

| California | 330 M→750 M* | 25 % + uplifts | Diversity & out‑zone bonuses |

*If the expansion passes

Timeline to Passage

- June 20 – Budget trailer bill slated for Senate vote.

- June 25 – Assembly floor vote expected.

- July 1 – Governor signature could make the enlarged California film and TV tax credit effective for the July 8 application window.

Practical Impact for Producers

- Series Doublers: Shows like American Horror Story, capped at $20 M/season, can now claim up to $40 M—enough to offset L.A. crew premiums.

- Indies at $15 M: Higher pools reduce waitlists, allowing mid‑budget features to lock financing without lottery risk.

- Competition Reality: Large‑scale shows (Top Chef, The Voice) become eligible, filling stages and prop warehouses quickly.

Industry Reaction

- DGA: “A vital step toward reclaiming California’s entertainment edge.”

- CalTax: “Lawmakers can’t buy love by handing studios taxpayer cash.”

- Netflix: Privately signals it will relocate a tent‑pole miniseries from New Mexico if the boost passes.

Outlook: Short‑Term Lifeline, Long‑Term Questions

Even supporters concede the expanded California film and TV tax credit won’t lure every tentpole away from U.K. soundstages dripping with subsidies. But they argue it buys time for a post‑strike workforce and stops further erosion of below‑the‑line jobs. As Patty Jenkins put it: “The door is closing. This keeps it cracked—now we need to push it wide open.”